I like HSA Accounts. They are great for saving taxes and paying for essential medical services with pre-tax money. I have an HSA Account - Da Vinci - and I have a good bit of money there - 2 Units at the last Taking Stock post.

Now the problem - LGB (Little Grey Butterfly, AKA my spouse and partner-in-crime) is no longer employed at the company that had the kind of insurance plan required for HSA. So we can't make HSA contributions any more. Fine. However, the problem is that the HSA Bank, the organization that runs our HSA Account, starts charging all kinds of fees the moment you are an independent account (compared to one still working with the company they have a relationship with).

Here is a list of fees by HSA Bank: Stupid Fees!

The two that hurt the most - mostly because a user has no control on them - is the Monthly Maintenance Fee of $2.50 and Monthly Investment Fee of $3.00. So $5.50 in fees every month just to have that account and to invest the balance in the account.

To avoid the fees, I would have to keep $5,000 balance in the HSA base account. The balance in the investment account does not count. Now, it would have been no trouble if the account gave a decent interest rate - but of course that is not the case. The current interest rate on balances below $15K is 0.65%. So if I keep a balance of $5K in HSA, then I would make a monthly interest of $2.71 while I would forgo an investment income of $20.83 (assuming a 5% return - which is conservative given that my current holding of JNK is returning close to 7%). So the choice is clear - keeping $5K balance is a loser by (20.83 - 2.71 - 5.50) = $12.62 per month. I am keeping ALL of my HSA Balance (except a couple hundreds to take care of medical bills as they arise) in the investment account - monthly fees be damned!

Today's Art: the ceiling of St. Ignatius' Church in Rome, Italy (since I will be there in just a couple days!). Where do the walls end and the painting begin - it is wonder.

I Save, most of which I Invest, rest I Trade with - and all of that is archived here along with some random thoughts and my favorite art.

Thursday, March 14, 2013

Sunday, March 10, 2013

Bernini Growth Rate Assumption

I have been considering a conservative growth rate assumption of 3% for the account Bernini. It is a pension account, managed by a state investment board. The board uses a smoothing approach to returns - smoothing returns over a five year period. The returns in the past years have been dismal (and hence the 3% assumption), not because the fund was doing poorly - but because the effects of year 2008 were still being felt. Now that we are in 2013, we are out of the five year smoothing window for 2008 - so the growth rate in 2013 should be pretty decent.

Given the fast pace of market growth in the first two months, I am revising the Bernini growth rate assumption to 12% - or 1% per year. I will not be updating the existing Taking Stock posts - but future Taking Stock posts will reflect the upward revision of Bernini account balance for last two months.

Bernini now stands at 12 Units. The total portfolio value (including market growth in past few days) is now 50.5 Units.

Given the fast pace of market growth in the first two months, I am revising the Bernini growth rate assumption to 12% - or 1% per year. I will not be updating the existing Taking Stock posts - but future Taking Stock posts will reflect the upward revision of Bernini account balance for last two months.

Bernini now stands at 12 Units. The total portfolio value (including market growth in past few days) is now 50.5 Units.

Wednesday, March 6, 2013

Current Asset Allocation

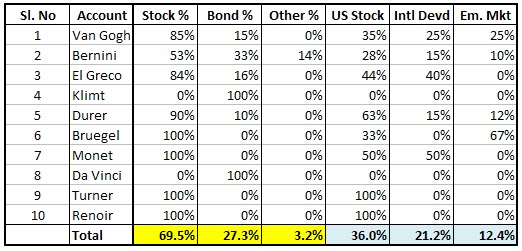

So I did some calculations to find out my overall asset allocation. Here are the results:

So, overall I am close to 70% Stocks and 30% Bonds (including others, which are mostly bond-like instruments). Of my total portfolio, 36% is US Stocks, 21% is International Developed World Stocks and 12.5% is Emerging Markets Stocks.

Prima facie, it feels like I am overexposed to the US market at the cost of my exposure to Emerging Markets. I am going to look to reduce my US Market allocation and increase allocation to Emerging Markets as opportunities present themselves.

Today's art is a little different. This is the famous Bean in Chicago's downtown lakefront by Anish Kapoor. The official name is Cloud Gate - and it is one of most accessible, interactive and popular work of art that I have ever seen.

So, overall I am close to 70% Stocks and 30% Bonds (including others, which are mostly bond-like instruments). Of my total portfolio, 36% is US Stocks, 21% is International Developed World Stocks and 12.5% is Emerging Markets Stocks.

Prima facie, it feels like I am overexposed to the US market at the cost of my exposure to Emerging Markets. I am going to look to reduce my US Market allocation and increase allocation to Emerging Markets as opportunities present themselves.

Today's art is a little different. This is the famous Bean in Chicago's downtown lakefront by Anish Kapoor. The official name is Cloud Gate - and it is one of most accessible, interactive and popular work of art that I have ever seen.

Tuesday, March 5, 2013

Taking Stock: Feb 2013

Total Portfolio Value: 50.2 Units

Van Gogh: 12 Units. 15% Bonds and 85% Stocks asset allocation. The 85% Stock allocation is divided between developed countries (25%), emerging markets (25%) and US market (35%). US market is further divided into NASDAQ Index (10%), S&P 500 Index (10%) and mid-caps and small caps (15%).Bernini: 11 Units. Currently budgeting a 3% growth rate in this account.

El Greco: 11 Units. 10% long term investment grade bonds and 90% stocks. Fidelity Contrafund, Vanguard Wellington and American Euro-Pacific Growth each gets 20%, 20% to Developed Ex-US to bring some geographical diversity and 10% to S&P 500 to absorb the reduction on bond allocation.

Klimt: 5 Units. Yield is further down - though still > 5%.

Durer: 3 Units. Target Retirement Fund with 2050 target. It is currently 90% Stock (67% US, 23% International) and 10% Bonds.

Bruegel: 3 Units.EPI, FXI and INTC. Emerging markets have been weak recently.

Monet: 2 Units. EWP and F. My best recent investment picks.

DaVinci: 2 Units. JNK bounced back, the yield improved mildly too..

Renoir and Turner: 1 Unit each in DEO and VZ. Both at all time highs. In addition, I am holding various amounts of DVY in different accounts to hold small sums accumulated through dividends.

Growth Since Last Taking Stock

The Jan 2013 Taking Stock had the total account value at 48.4 Units - so we are looking at a growth of 1.8 Units - 3.72% in a month. YTM 7.73%. We have reached 50+ Units of total portfolio value. Nice.

Subscribe to:

Comments (Atom)