After a long while I took a full account of my investments. Here are the details:

Total Amount: 58.5 Units

Stock: 70%, Bond: 24%, Other: 6%

Within Stocks: US 45%, International Developed: 29%, Emerging Markets: 26%

All Inclusive: US Stk 31%, Intl Devd 21%, Emerg Mkt 18%, Bonds 24%, Others 6%

I seem to be pretty high in Stocks right now - perhaps a little movement towards bonds would make sense. Also, I am a little high on Emerging Markets at the cost of International Developed Markets. Overall though I am fine with my current asset allocation.

I Save, most of which I Invest, rest I Trade with - and all of that is archived here along with some random thoughts and my favorite art.

Wednesday, September 18, 2013

Thursday, May 9, 2013

Real Emerging Markets

I have a large Emerging Markets allocation (18% at last count). I own broad EM ETFs and MFs. However, these broad instruments suffer from the problem of being heavily concentrated in just a few markets. For example - VWO has the following composition:

China - 18%, S. Korea 14%, Brazil 12%, Taiwan 10%, S. Africa 8%, India 7%, Mexico 5%, Russia 5%

Now, of the above, many are so well invested that they can hardly be considered "Emerging". Especially S. Korea and Taiwan seem like almost at their peak potential - already "Emerged" so to speak. These are rich countries with GDP per-capita of $31K and $38K respectively - they really should be moved to Developed Ex-US category (EFA) already.

In my view, for a country to be considered "Emerging", the country should be first, relatively less affluent so that a higher growth trajectory is feasible and second, politically and socially stable so that the higher growth trajectory is realizable. With that in mind, I propose the following heuristics

8 Iran 1.0 13.2K 2

11 Egypt 0.5 6.5K 1

13 Pakistan 0.5 2.8K 2

14 Colombia 0.5 10.2K 2

17 Ukrain 0.3 7.2K 3 NA

20 Bangladesh 0.3 1.9K 3 NA

China - 18%, S. Korea 14%, Brazil 12%, Taiwan 10%, S. Africa 8%, India 7%, Mexico 5%, Russia 5%

Now, of the above, many are so well invested that they can hardly be considered "Emerging". Especially S. Korea and Taiwan seem like almost at their peak potential - already "Emerged" so to speak. These are rich countries with GDP per-capita of $31K and $38K respectively - they really should be moved to Developed Ex-US category (EFA) already.

In my view, for a country to be considered "Emerging", the country should be first, relatively less affluent so that a higher growth trajectory is feasible and second, politically and socially stable so that the higher growth trajectory is realizable. With that in mind, I propose the following heuristics

- GDP Per-Capita below either the world average ($11.5K) or the neighborhood average

- A minimum economy size of $300B

- Politically and socially stable. I have ranked the countries on a scale from 1 (Unstable) to 5 (Stable)

Using the criteria above, we get the following list (ordered by the size of the economy):

# Country GDP ($T) GDP Per Capita ($) Stability Rating ETF

1 China 12.4 8.4K 3 FXI

2 India 4.7 3.7K 4 EPI

3 Russia 3.0 16.7K 3 RSX

4 Brazil 2.3 11.8K 4 EWZ

5 Mexico 1.8 14.7K 4 EWW

6 Indonesia 1.2 4.7K 3 EIDO

7 Turkey 1.1 14.4K 4 TUR

9 Thailand 0.6 9.4K 3 THD

10 S. Africa 0.6 11.0K 3 EWA

15 Philippines0.4 4.0K 3 EPHE

16 Nigeria 0.4 2.6K 3 NGR

18 Peru 0.3 10.0K 4 EPU

19 Vietnam 0.3 3.4K 3 VNM

So I have a list of 20 countries - of which four are unstable and hence not a good investment target at this time. Among the rest, Ukrain and Bangladesh do not have a country ETF readily available. So that leaves 14 investable targets. My plan is to take long term positions in all of these - positions that I hold for 20+ years while these countries work through their growth pangs. I have already taken positions in all of them except THD, EPHE, EPU and VNM (the bold in table above represents a long position). My current position in NGR is tentative considering the extremely low volumes that it has.

I know that not all of the above holdings are going to work out - but I think I have a better distribution this way than the VWO folks - and hence a better shot at capturing the future growth in the emerging (or poorer, by my definition) economies shown above. Now, fingers crossed and let the long wait begin.

Today's art is my favorite part of Sistine Chapel Ceiling - The Libyan Sybil. I found these small Sybil paintings much more engrossing than the really-well-composed-but-somehow-feeling-quite-empty Creation of Adam.

Monday, May 6, 2013

Asset Allocation Update

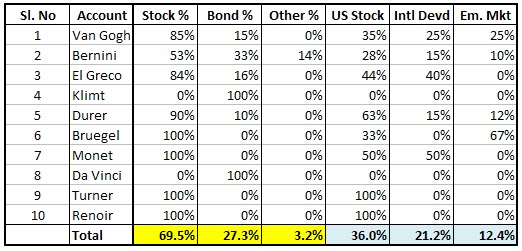

My asset allocation has changed as a result of recent re-balancing and recent account mergers. My last asset allocation post saw a 70-30 Stock Bond split with 36% US Stocks, 21% Developed Ex-Us Stock and 12% Emerging Markets Stock. Now, the current situation:

The Other portion is mostly Real Estate. I have reduced the bond portfolio a little bit - mostly because I want to keep them in Klimt, Bernini and El Greco - they have better debt fund options - especially Klimt.

I am fine with this AA. I am quite heavy on Emerging Markets - but that is by design. I am investing for next 30-40 years - and I believe that emerging markets will outperform developed markets significantly over that long a horizon.

The Other portion is mostly Real Estate. I have reduced the bond portfolio a little bit - mostly because I want to keep them in Klimt, Bernini and El Greco - they have better debt fund options - especially Klimt.

I am fine with this AA. I am quite heavy on Emerging Markets - but that is by design. I am investing for next 30-40 years - and I believe that emerging markets will outperform developed markets significantly over that long a horizon.

Consolidating Brokerage Accounts

Right now my money is distributed in 10 different accounts - surely not an ideal situation. So, to remedy, I have taken the following two steps:

- Transfer out of Scottrade: Turner has been moved from Scottrade to Fidelity. It is a non-deductible IRA - and is better positioned with all the other IRAs in my Fidelity account.

- Roll out old 401K to Fidelity: Durer, an old 401K account, has been merged with Monet, a Fidelity Rollover IRA as part of the rollover process. This helps me get out of stupid fees for old 401Ks. Also, IRAs have much wider investment choices. The Durer account is no more. Monet is now a fat 5 Units account - 4th largest account in the portfolio.

Now I have accounts with Fidelity, Vanguard and TD Ameritrade. Total of 9 accounts.

Today's art is also from my recent visit to Rome. Part of the ceiling of the Gesu Church - home of the Jesuits. One place in Rome where I felt like a church actually had an air of spiritual calm, despite the ostentatious decorations.

Today's art is also from my recent visit to Rome. Part of the ceiling of the Gesu Church - home of the Jesuits. One place in Rome where I felt like a church actually had an air of spiritual calm, despite the ostentatious decorations.

Saturday, May 4, 2013

Taking Stock: April 2013

Time again for a Taking Stock post. Here is the state of affairs at the end of April 2013.

Bernini: 13

El Greco: 12

Klimt: 5

Durer and Bruegel: 3 each

Monet and Da Vinci: 2 each

Renoir and Turner: 1 each

Total: 55.3 Units

Van Gogh: 14Bernini: 13

El Greco: 12

Klimt: 5

Durer and Bruegel: 3 each

Monet and Da Vinci: 2 each

Renoir and Turner: 1 each

Change Over Last Month

The last Taking Stock had the total portfolio value at 52.2 Units - so we have a net 3.1 unit change in a month. That represents a 5.94% monthly growth including new contributions. Market has done really well last month and the portfolio reflects that. Considering that the total portfolio value at the start of the year was 46.6 Units, we have a YTM growth of 18.67%. This year is turning out well so far.

Thursday, May 2, 2013

Fidelity and 457 Rebalancing Done

Just finished rebalancing of the two biggest accounts under my control. My Fidelity 403B account (Van Gogh) now has the following asset allocation:

EFA: 20%, VWO: 20%, Global Ex-US: 10%, SPY: 10%, US Medium/Small Cap: 10%, US REIT Index: 10%, Long Term Treasuries: 10%, US Long Term Corporate Bonds: 10%

The 457 account (El Greco) now has the following asset allocation:

Fidelity Contrafund: 25%, American Euro-Pacific Growth: 25%, Vanguard Wellington: 25%, Vanguard Long Term Investment Grade Bonds: 25%.

I think this rebalancing will increase my overall emerging market allocation and bond allocation. I will have concrete numbers later in the month when I feed in the new numbers into the spreadsheet. Overall I am targeting a 70-30 Stock-Bond split with a 30 US, 20 Ex-US Developed and 20 Emerging Markets distribution for stocks.

EFA: 20%, VWO: 20%, Global Ex-US: 10%, SPY: 10%, US Medium/Small Cap: 10%, US REIT Index: 10%, Long Term Treasuries: 10%, US Long Term Corporate Bonds: 10%

The 457 account (El Greco) now has the following asset allocation:

Fidelity Contrafund: 25%, American Euro-Pacific Growth: 25%, Vanguard Wellington: 25%, Vanguard Long Term Investment Grade Bonds: 25%.

I think this rebalancing will increase my overall emerging market allocation and bond allocation. I will have concrete numbers later in the month when I feed in the new numbers into the spreadsheet. Overall I am targeting a 70-30 Stock-Bond split with a 30 US, 20 Ex-US Developed and 20 Emerging Markets distribution for stocks.

Thursday, April 25, 2013

Rebalancing 457 Account

El Greco is my 457 account with a decent balance of about 12 Units now. I have decided to keep this account as my test bed for active investing - I keep actively managed mutual funds here. However, my current asset allocation in this account has some pretty significant problems:

- I have both EFA and the Euro Pacific Growth Fund - they essentially replicate each other. Keeping with the account's focus on actively managed MFs - I will get rid of EFA from here.

- I have reduced my Bonds allocation too low in here. I am coming around to a 70-30 Stock-Bond split as a minimum. So I will increase allocation for the bond fund here.

With the above in mind, I expect the following asset allocation in this account when I rebalance at the start of May:

Fidelity Contrafund 25% ER 0.74%

Vanguard Wellington 25% ER 0.17%

American EuroPacific Growth 25% ER 0.50%

Vanguard Long Term Investment Grade Bonds 25% ER 0.12%

Some thoughts on above:

- Since Wellington is a balanced fund with some 33% bond allocation - the portfolio above is about 25 + (0.33 * 25) = 33% bonds. This is fine with my 70-30 asset allocation.

- I am not happy with 0.74% ER for Contrafund. I am going to watch its performance closely to see if its worth its expense.

- Pleasantly surprised with the low ER for Wellington. Vanguard is earning my trust.

- The range of investment choices in this account is really poor - I really need a decent Emerging Markets choice here. Well - I will have to make that deficit up in a different account.

Wednesday, April 24, 2013

Rebalancing Fidelity Funds

Fidelity is my largest platform. My largest account - Van Gogh, 13 Units, is with Fidelity. I have adopted a passive, index fund based approach to this account. Put an asset allocation, rebalance every quarter and then forget until the next rebalance date.

It is time again to rebalance - and also an opportunity to evaluate my fund choices. Recently, I have been reading Bogleheads and have started putting a lot more focus on Expense Ratios of mutual funds. So here goes the current state of affairs:

Spartan International Index 20% ER 0.17%

Spartan Emerging Markets Index 20% ER 0.35%

Spartan Extended Market Index 10% ER 0.07%

Spartan 500 Index 10% ER 0.05%

Fidelity NASDAQ Composite Index 10% ER 0.58%

Fidelity Long Term Treasuries Index 10% ER 0.10%

Fidelity Investment Grade Bonds 10% ER 0.45%

Fidelity New Markets Income 10% ER 0.87%

As we can see above, most of the fund choices are reasonable in their Expense Ratios. The only one that seems quite out of line is the Fidelity New Markets Income and to some extent, the Fidelity NASDAQ Composite Index. Really, there is no reason why an index fund should cost more than 0.50%. So I need to look for replacements for these two.

Fidelity makes it really difficult to find low cost funds. The list of funds do not show their ERs - you need to go to the specific fund's page to find that out. There is no way to sort funds by their ERs. You can screen funds by a maximum ER threshold - if you can find your way to the advanced screening option. Well - these are small roadblocks - I don't know why Fidelity bothers putting them up (just bad design perhaps) - but half hour on the website is enough to unravel these. I have spent the time - and have emerged with the following conclusions:

Spartan International Index 20% ER 0.17%

Spartan Emerging Markets Index 20% ER 0.35%

Spartan Extended Market Index 10% ER 0.07%

Spartan 500 Index 10% ER 0.05%

Spartan Real Estate Index Fund 10% ER 0.20%

Fidelity Long Term Treasuries Index 15% ER 0.10%

Fidelity Corporate Bonds Fund 15% ER 0.45%

That looks reasonable. I wish I had another bond fund candidate so that all three could have a 10% allocation.

Update: I have another candidate fund - Spartan Global ex-US Index Fund - has a low ER 0.28%. It is about 78% Developed ex-USA and 22% EM. I can put 10% here and bring down the two bond funds to 10% each.

It is time again to rebalance - and also an opportunity to evaluate my fund choices. Recently, I have been reading Bogleheads and have started putting a lot more focus on Expense Ratios of mutual funds. So here goes the current state of affairs:

Spartan International Index 20% ER 0.17%

Spartan Emerging Markets Index 20% ER 0.35%

Spartan Extended Market Index 10% ER 0.07%

Spartan 500 Index 10% ER 0.05%

Fidelity NASDAQ Composite Index 10% ER 0.58%

Fidelity Long Term Treasuries Index 10% ER 0.10%

Fidelity Investment Grade Bonds 10% ER 0.45%

Fidelity New Markets Income 10% ER 0.87%

As we can see above, most of the fund choices are reasonable in their Expense Ratios. The only one that seems quite out of line is the Fidelity New Markets Income and to some extent, the Fidelity NASDAQ Composite Index. Really, there is no reason why an index fund should cost more than 0.50%. So I need to look for replacements for these two.

Fidelity makes it really difficult to find low cost funds. The list of funds do not show their ERs - you need to go to the specific fund's page to find that out. There is no way to sort funds by their ERs. You can screen funds by a maximum ER threshold - if you can find your way to the advanced screening option. Well - these are small roadblocks - I don't know why Fidelity bothers putting them up (just bad design perhaps) - but half hour on the website is enough to unravel these. I have spent the time - and have emerged with the following conclusions:

- Fidelity New Markets Income is gone. I will replace it with Spartan Real Estate Index Fund (FSRVX). This fund has an ER of 0.20% and it follows the DJ Real Estate Index - the corresponding ETF is IYR. I did want to have an exposure to RE.

- Fidelity Investment Grade Bonds is gone. I will replace it with Fidelity Corporate Bond Fund (FCBFX). The two funds have the same ER - but I get bonds with much longer duration (and hence higher yield) with FCBFX.

- Remove NASDAQ Index Fund. Its 10% allocation will be taken by the REIT fund.

- To continue to have a 70-30 Stock-Bond split, the two bond funds will now have 15% allocation each.

Spartan International Index 20% ER 0.17%

Spartan Emerging Markets Index 20% ER 0.35%

Spartan Extended Market Index 10% ER 0.07%

Spartan 500 Index 10% ER 0.05%

Spartan Real Estate Index Fund 10% ER 0.20%

Fidelity Long Term Treasuries Index 15% ER 0.10%

Fidelity Corporate Bonds Fund 15% ER 0.45%

That looks reasonable. I wish I had another bond fund candidate so that all three could have a 10% allocation.

Update: I have another candidate fund - Spartan Global ex-US Index Fund - has a low ER 0.28%. It is about 78% Developed ex-USA and 22% EM. I can put 10% here and bring down the two bond funds to 10% each.

Thursday, April 4, 2013

Generating Consistent Income From Investments

One of my accounts (Da Vinci, 2 Units) is an HSA account. I want to invest these funds in a way that they generate consistent income so that I can use the income to fund small medical bills. So far, I have relied on JNK for the purpose - a nice 6.7% yield. However, dividend payouts in JNK has been dropping every month; there is talk of a bubble in junk bonds - and I think I am losing the opportunity for capital growth by keeping JNK long term. So I want to diversify my holdings here.

I have four constraints while diversifying here. First - I would like to get some emerging markets exposure since I think I am under-invested in emerging markets currently. Second - I would like to get some real estate in the mix since right now I don't have any. Third - I would like all assets in this account to be high yield with preferably monthly dividends. Lastly, to avoid trading costs, I would like to only include ETFs from TD Ameritrade's commission free ETF list, as far as possible.

After searching far and wide - this is my tentative list:

1. JNK - nothing beats the high yield and monthly payout. I will reduce the size of this holding significantly and focus on building it back up using dollar cost averaging so as to minimize capital risk.

2. RWX - International real estate. Very high yield (6.49%) and emerging markets plus REIT exposure.

3. DEM - International dividend paying stocks. This is not part of TD's commission free ETFs - so I would make a one time significant purchase of DEM and then let that be.

4. VYM - US dividend paying stocks.

I will start by re-allocating my portfolio to have JNK 10%, RWX 10%, DEM 40% and VYM 40%. Any dividend will be pushed into JNK or RWX, unless they are needed for current medical bills. Holding in DEM and VYM will be left along for long term portfolio. VYM will be sold first in case of larger medical bills (no-commission) and DEM will be the last to be sold, if needed.

I think this is a good plan. I will implement is around end of the month when JNK moves out of the 30-day window for commission free trades.

Today's art is another of Rome's spectacles - The Trevi Fountain - a sight to behold, especially at night.

I have four constraints while diversifying here. First - I would like to get some emerging markets exposure since I think I am under-invested in emerging markets currently. Second - I would like to get some real estate in the mix since right now I don't have any. Third - I would like all assets in this account to be high yield with preferably monthly dividends. Lastly, to avoid trading costs, I would like to only include ETFs from TD Ameritrade's commission free ETF list, as far as possible.

After searching far and wide - this is my tentative list:

1. JNK - nothing beats the high yield and monthly payout. I will reduce the size of this holding significantly and focus on building it back up using dollar cost averaging so as to minimize capital risk.

2. RWX - International real estate. Very high yield (6.49%) and emerging markets plus REIT exposure.

3. DEM - International dividend paying stocks. This is not part of TD's commission free ETFs - so I would make a one time significant purchase of DEM and then let that be.

4. VYM - US dividend paying stocks.

I will start by re-allocating my portfolio to have JNK 10%, RWX 10%, DEM 40% and VYM 40%. Any dividend will be pushed into JNK or RWX, unless they are needed for current medical bills. Holding in DEM and VYM will be left along for long term portfolio. VYM will be sold first in case of larger medical bills (no-commission) and DEM will be the last to be sold, if needed.

I think this is a good plan. I will implement is around end of the month when JNK moves out of the 30-day window for commission free trades.

Today's art is another of Rome's spectacles - The Trevi Fountain - a sight to behold, especially at night.

Wednesday, April 3, 2013

Pre-Paying Mortgage: Pros and Cons

I have read all the pros and cons of pre-paying your mortgage. I had been a convert to the pay-it-quickly mindset - and have been typically putting in double the principal payment each month. However, I have now reconsidered. I am now putting just the regular payment (rounded up to the nearest hundred - old habits die hard!). The argument that won me over was in a blog comment (unfortunately I don't recall which - perhaps Get Rich Slowly). The argument goes as follows (paraphrased in my words):

Since I just got back from Rome, here is, in my opinion, the best sight in Rome. The Sistine Chapel Side Frescos. Yes - the ceiling by Michelangelo is great - but I found the side frescoes to be the real star. The one below by Botticelli, called "The Temptation of Christ" is my favorite.

The problem with mortgages are that they essentially reset every month. The fact that you prepaid thousands of dollars of principal this month does not mean anything as far as the next month's payment is concerned. If you miss the deadline next month - you are in default and are soon looking at foreclosure. We don't know the future - shit can and will happen. Instead of pre-paying the mortgage, put that additional payment into a dedicated investment account with a low risk interest bearing instrument. You will get the same or more in return as the after-tax mortgage rate - so you are not losing money. But - now you have the flexibility of continuing to make your payments. If this reserve gets too big then take a portion and make a lump-sum payment to your mortgage. Best of both worlds!I completely agree with the argument above. I am growing more risk-averse as I am growing older - and this fits with my evolving risk taking profile. Mitigate the risk of future default by keeping aside the mortgage prepayment money. It will still go to the mortgage - but at a later date of my choosing and after working as a foreclosure insurance.

Since I just got back from Rome, here is, in my opinion, the best sight in Rome. The Sistine Chapel Side Frescos. Yes - the ceiling by Michelangelo is great - but I found the side frescoes to be the real star. The one below by Botticelli, called "The Temptation of Christ" is my favorite.

Taking Stock: March 2013

Another new month and with it - another Taking Stock post. Mar 2013 has been good - markets have done well - so I expect my nest egg should have grown a bit. Lets take a look:

Bernini: 12

El Greco: 11

Klimt: 5

Durer and Bruegel: 3 each

Monet and Da Vinci: 2 each

Renoir and Turner: 1 each

Total Portfolio Value: 52.2 Units

Van Gogh: 13Bernini: 12

El Greco: 11

Klimt: 5

Durer and Bruegel: 3 each

Monet and Da Vinci: 2 each

Renoir and Turner: 1 each

Change Over Last Month

The last Taking Stock had the total portfolio value at 50.2 Units - so we have a net 2.0 unit change in a month. That represents a 3.98% monthly growth including new contributions. Considering that the total portfolio value at the start of the year was 46.6 Units, we have a YTM growth of 12.02%. Not too shabby!

Thursday, March 14, 2013

HSA Account Fees - Horrible!

I like HSA Accounts. They are great for saving taxes and paying for essential medical services with pre-tax money. I have an HSA Account - Da Vinci - and I have a good bit of money there - 2 Units at the last Taking Stock post.

Now the problem - LGB (Little Grey Butterfly, AKA my spouse and partner-in-crime) is no longer employed at the company that had the kind of insurance plan required for HSA. So we can't make HSA contributions any more. Fine. However, the problem is that the HSA Bank, the organization that runs our HSA Account, starts charging all kinds of fees the moment you are an independent account (compared to one still working with the company they have a relationship with).

Here is a list of fees by HSA Bank: Stupid Fees!

The two that hurt the most - mostly because a user has no control on them - is the Monthly Maintenance Fee of $2.50 and Monthly Investment Fee of $3.00. So $5.50 in fees every month just to have that account and to invest the balance in the account.

To avoid the fees, I would have to keep $5,000 balance in the HSA base account. The balance in the investment account does not count. Now, it would have been no trouble if the account gave a decent interest rate - but of course that is not the case. The current interest rate on balances below $15K is 0.65%. So if I keep a balance of $5K in HSA, then I would make a monthly interest of $2.71 while I would forgo an investment income of $20.83 (assuming a 5% return - which is conservative given that my current holding of JNK is returning close to 7%). So the choice is clear - keeping $5K balance is a loser by (20.83 - 2.71 - 5.50) = $12.62 per month. I am keeping ALL of my HSA Balance (except a couple hundreds to take care of medical bills as they arise) in the investment account - monthly fees be damned!

Today's Art: the ceiling of St. Ignatius' Church in Rome, Italy (since I will be there in just a couple days!). Where do the walls end and the painting begin - it is wonder.

Now the problem - LGB (Little Grey Butterfly, AKA my spouse and partner-in-crime) is no longer employed at the company that had the kind of insurance plan required for HSA. So we can't make HSA contributions any more. Fine. However, the problem is that the HSA Bank, the organization that runs our HSA Account, starts charging all kinds of fees the moment you are an independent account (compared to one still working with the company they have a relationship with).

Here is a list of fees by HSA Bank: Stupid Fees!

The two that hurt the most - mostly because a user has no control on them - is the Monthly Maintenance Fee of $2.50 and Monthly Investment Fee of $3.00. So $5.50 in fees every month just to have that account and to invest the balance in the account.

To avoid the fees, I would have to keep $5,000 balance in the HSA base account. The balance in the investment account does not count. Now, it would have been no trouble if the account gave a decent interest rate - but of course that is not the case. The current interest rate on balances below $15K is 0.65%. So if I keep a balance of $5K in HSA, then I would make a monthly interest of $2.71 while I would forgo an investment income of $20.83 (assuming a 5% return - which is conservative given that my current holding of JNK is returning close to 7%). So the choice is clear - keeping $5K balance is a loser by (20.83 - 2.71 - 5.50) = $12.62 per month. I am keeping ALL of my HSA Balance (except a couple hundreds to take care of medical bills as they arise) in the investment account - monthly fees be damned!

Today's Art: the ceiling of St. Ignatius' Church in Rome, Italy (since I will be there in just a couple days!). Where do the walls end and the painting begin - it is wonder.

Sunday, March 10, 2013

Bernini Growth Rate Assumption

I have been considering a conservative growth rate assumption of 3% for the account Bernini. It is a pension account, managed by a state investment board. The board uses a smoothing approach to returns - smoothing returns over a five year period. The returns in the past years have been dismal (and hence the 3% assumption), not because the fund was doing poorly - but because the effects of year 2008 were still being felt. Now that we are in 2013, we are out of the five year smoothing window for 2008 - so the growth rate in 2013 should be pretty decent.

Given the fast pace of market growth in the first two months, I am revising the Bernini growth rate assumption to 12% - or 1% per year. I will not be updating the existing Taking Stock posts - but future Taking Stock posts will reflect the upward revision of Bernini account balance for last two months.

Bernini now stands at 12 Units. The total portfolio value (including market growth in past few days) is now 50.5 Units.

Given the fast pace of market growth in the first two months, I am revising the Bernini growth rate assumption to 12% - or 1% per year. I will not be updating the existing Taking Stock posts - but future Taking Stock posts will reflect the upward revision of Bernini account balance for last two months.

Bernini now stands at 12 Units. The total portfolio value (including market growth in past few days) is now 50.5 Units.

Wednesday, March 6, 2013

Current Asset Allocation

So I did some calculations to find out my overall asset allocation. Here are the results:

So, overall I am close to 70% Stocks and 30% Bonds (including others, which are mostly bond-like instruments). Of my total portfolio, 36% is US Stocks, 21% is International Developed World Stocks and 12.5% is Emerging Markets Stocks.

Prima facie, it feels like I am overexposed to the US market at the cost of my exposure to Emerging Markets. I am going to look to reduce my US Market allocation and increase allocation to Emerging Markets as opportunities present themselves.

Today's art is a little different. This is the famous Bean in Chicago's downtown lakefront by Anish Kapoor. The official name is Cloud Gate - and it is one of most accessible, interactive and popular work of art that I have ever seen.

So, overall I am close to 70% Stocks and 30% Bonds (including others, which are mostly bond-like instruments). Of my total portfolio, 36% is US Stocks, 21% is International Developed World Stocks and 12.5% is Emerging Markets Stocks.

Prima facie, it feels like I am overexposed to the US market at the cost of my exposure to Emerging Markets. I am going to look to reduce my US Market allocation and increase allocation to Emerging Markets as opportunities present themselves.

Today's art is a little different. This is the famous Bean in Chicago's downtown lakefront by Anish Kapoor. The official name is Cloud Gate - and it is one of most accessible, interactive and popular work of art that I have ever seen.

Tuesday, March 5, 2013

Taking Stock: Feb 2013

Total Portfolio Value: 50.2 Units

Van Gogh: 12 Units. 15% Bonds and 85% Stocks asset allocation. The 85% Stock allocation is divided between developed countries (25%), emerging markets (25%) and US market (35%). US market is further divided into NASDAQ Index (10%), S&P 500 Index (10%) and mid-caps and small caps (15%).Bernini: 11 Units. Currently budgeting a 3% growth rate in this account.

El Greco: 11 Units. 10% long term investment grade bonds and 90% stocks. Fidelity Contrafund, Vanguard Wellington and American Euro-Pacific Growth each gets 20%, 20% to Developed Ex-US to bring some geographical diversity and 10% to S&P 500 to absorb the reduction on bond allocation.

Klimt: 5 Units. Yield is further down - though still > 5%.

Durer: 3 Units. Target Retirement Fund with 2050 target. It is currently 90% Stock (67% US, 23% International) and 10% Bonds.

Bruegel: 3 Units.EPI, FXI and INTC. Emerging markets have been weak recently.

Monet: 2 Units. EWP and F. My best recent investment picks.

DaVinci: 2 Units. JNK bounced back, the yield improved mildly too..

Renoir and Turner: 1 Unit each in DEO and VZ. Both at all time highs. In addition, I am holding various amounts of DVY in different accounts to hold small sums accumulated through dividends.

Growth Since Last Taking Stock

The Jan 2013 Taking Stock had the total account value at 48.4 Units - so we are looking at a growth of 1.8 Units - 3.72% in a month. YTM 7.73%. We have reached 50+ Units of total portfolio value. Nice.Sunday, February 3, 2013

Get Ready for Gold and Silver to Head South

I have never personally liked precious metals like Gold (GLD) and Silver (SLV) - or the related Gold Miners (GDX) as investment vehicles. My basic objection is that they don't have any underlying logic for continued growth - they don't have any economic utility except being the object of speculation.

No doubt Gold and Silver have had an amazing run past few years - GLD has gone from 42 in early 2005 to 180+ in Aug 2011. That's 4x growth in 6 years - impressive - but in my opinion mainly because of the economic uncertainty of past few years. Since touching the high in mid-2011, GLD has been stagnant - and I don't think its going to come close to the high of 180+ anytime soon. If anything, I expect GLD to plunge as risk appetite grows in light of continued improvement in economic climate along with improvement in the stock market. The 2 year GLD chart clearly shows the current stagnant nature of Gold prices:

The downturn is more evident in the SLV charts.

Now, finally, the canary in the coal (gold?) mine - Gold Miners (GDX):

I think the inevitable pullback in precious metals is only a matter of time. I do not have any holdings in Gold or Silver. I am usually averse to shorting stocks - but I might be willing to bet some money on shorting GLD when the downturn becomes apparent.

It might be really long before India's obsession with Gold will end - but when it does and India starts bringing its hoard of Gold into the world market - watch out. India is sitting on world's largest retail stockpile of Gold in the world - and sooner or later, that mountain of Gold will be taken out and sold - with the attendant collapse in Gold prices. It is going to happen - it will be a good thing for the country when it does - but that will be the last straw for the Gold market.

It is easy to forget that after the last big bull run in Gold prices that ended in early 1980s, Gold went through a more than 20 year bear market (not coincidentally, it was alongside a boom in equities) and lost more than half its value in that period. I believe we are done with the Gold bull run of the 2000s and are now heading towards a similar long term bear market.

After peaking in 2011, Gold imports to India are already declining. Indian households, it seems, currently hold more than 18,000 tons of Gold. In comparison, the entire GLD ETF - the largest Gold investment vehicle in the world - holds just about 1000 tons of Gold!

No doubt Gold and Silver have had an amazing run past few years - GLD has gone from 42 in early 2005 to 180+ in Aug 2011. That's 4x growth in 6 years - impressive - but in my opinion mainly because of the economic uncertainty of past few years. Since touching the high in mid-2011, GLD has been stagnant - and I don't think its going to come close to the high of 180+ anytime soon. If anything, I expect GLD to plunge as risk appetite grows in light of continued improvement in economic climate along with improvement in the stock market. The 2 year GLD chart clearly shows the current stagnant nature of Gold prices:

The downturn is more evident in the SLV charts.

Now, finally, the canary in the coal (gold?) mine - Gold Miners (GDX):

I think the inevitable pullback in precious metals is only a matter of time. I do not have any holdings in Gold or Silver. I am usually averse to shorting stocks - but I might be willing to bet some money on shorting GLD when the downturn becomes apparent.

Role of India

I have a long term bearish view of Gold with my view (wish?) that India will one day wake up from its addiction of Gold. As modern financial services penetrate the rural bits of India and more people become accustomed to letting their money work for them in stock/bond markets - I hope they will then stop blindingly putting their money in Gold. I further hope that the coming pullback in Gold prices will make people realize that Gold is not as safe a storage of value as they had hoped.It might be really long before India's obsession with Gold will end - but when it does and India starts bringing its hoard of Gold into the world market - watch out. India is sitting on world's largest retail stockpile of Gold in the world - and sooner or later, that mountain of Gold will be taken out and sold - with the attendant collapse in Gold prices. It is going to happen - it will be a good thing for the country when it does - but that will be the last straw for the Gold market.

Some Interesting Data on Gold

All the Gold in world comes to around 165,000 metric tons. Annual production is around 2,500 metric tons - of which India consumes around 750, China around 430 and USA around 130 metric tons. (Source: NumberSleuth)It is easy to forget that after the last big bull run in Gold prices that ended in early 1980s, Gold went through a more than 20 year bear market (not coincidentally, it was alongside a boom in equities) and lost more than half its value in that period. I believe we are done with the Gold bull run of the 2000s and are now heading towards a similar long term bear market.

After peaking in 2011, Gold imports to India are already declining. Indian households, it seems, currently hold more than 18,000 tons of Gold. In comparison, the entire GLD ETF - the largest Gold investment vehicle in the world - holds just about 1000 tons of Gold!

Taking Stock: Jan 2013

First month of 2013 is done - and what a month it was! Stocks did pretty well. My stocks did pretty well and I feel good about my investment decisions. Here is where things stand at the end of Jan - in the usual Taking Stock format:

Bernini: 11 Units. Hope the professional folks are taking care of this. I am currently budgeting a 3% growth rate in this account. I hope they will prove me wrong.

El Greco: 11 Units. This account is my bet on professional money managers. Currently in a stock-heavy allocation of 10% long term investment grade bonds and 90% stocks. Fidelity Contrafund, Vanguard Wellington and American Euro-Pacific Growth each gets 20%, 20% to Developed Ex-US to bring some geographical diversity and 10% to S&P 500 to absorb the reduction on bond allocation.

Klimt: 4 Units. My safest account - a fixed rate fund that is currently paying close to 5.5%. The bad news is that this yield is going down every month. I will think about shifting this out once (and if) the yield goes below 5%.

Durer: 3 Units. Target Retirement Fund with 2050 target. It is currently 90% Stock (67% US, 23% International) and 10% Bonds. I have an IRA ready to absorb this old 401K account - will do the transition as soon as the current bull run in stocks seem like done. Right now this fund is just tracking stocks and doing quite well.

Bruegel: 3 Units. I have EPI, FXI and INTC here. All are long term holdings for me - all good so far. INTC is a little weak - but with 4.5% dividends - I have no complaints.

Monet: 2 Units. I am holding EWP and F here. Both are on a nice upswing. F took a bit of hit after the numbers last quarter - but is still fine. They are again long term holdings - so who cares - let them mature.

Da Vinci: 2 Units. JNK is showing some weakness along with the rest of the bonds world. This, however, I am going to hold steady. The plan is to just put back the monthly dividend (currently a healthy 6.78%) into JNK and increase the number of shares I have. I am not going to worry about the share price - it will get dollar averaged every month anyways.

Renoir and Turner: 1 Unit each in DEO and VZ. Both doing fine. In addition, I am holding various amounts of DVY in different accounts to hold small sums accumulated through dividends.

Artwork of the day - not really one artwork - but the place that holds Bernini's masterpiece - Santa Maria Della Vittoria Church in Rome. This is of special significance - since I will be visiting Rome soon and will be staying at a hotel right next to this magnificent building.

Total Portfolio Value: 48.4 Units

Van Gogh: 12 Units. My largest account is currently sporting a 15% Bonds and 85% Stocks asset allocation. I have reduced my bonds holdings in anticipation of the coming bond crash. Bond holdings are equally distributed between long term treasuries, long term investment grade bonds and developing countries bonds. The 85% Stock allocation is divided between developed countries (25%), emerging markets (25%) and US market (35%). US market is further divided into NASDAQ Index (10%), S&P 500 Index (10%) and mid-caps and small caps (15%). This allocation is my stock-heavy allocation since I anticipate stocks to outperform bonds in next 3 months. I will adjust allocation in next rebalancing if I expect the relative performance expectations to change.Bernini: 11 Units. Hope the professional folks are taking care of this. I am currently budgeting a 3% growth rate in this account. I hope they will prove me wrong.

El Greco: 11 Units. This account is my bet on professional money managers. Currently in a stock-heavy allocation of 10% long term investment grade bonds and 90% stocks. Fidelity Contrafund, Vanguard Wellington and American Euro-Pacific Growth each gets 20%, 20% to Developed Ex-US to bring some geographical diversity and 10% to S&P 500 to absorb the reduction on bond allocation.

Klimt: 4 Units. My safest account - a fixed rate fund that is currently paying close to 5.5%. The bad news is that this yield is going down every month. I will think about shifting this out once (and if) the yield goes below 5%.

Durer: 3 Units. Target Retirement Fund with 2050 target. It is currently 90% Stock (67% US, 23% International) and 10% Bonds. I have an IRA ready to absorb this old 401K account - will do the transition as soon as the current bull run in stocks seem like done. Right now this fund is just tracking stocks and doing quite well.

Bruegel: 3 Units. I have EPI, FXI and INTC here. All are long term holdings for me - all good so far. INTC is a little weak - but with 4.5% dividends - I have no complaints.

Monet: 2 Units. I am holding EWP and F here. Both are on a nice upswing. F took a bit of hit after the numbers last quarter - but is still fine. They are again long term holdings - so who cares - let them mature.

Da Vinci: 2 Units. JNK is showing some weakness along with the rest of the bonds world. This, however, I am going to hold steady. The plan is to just put back the monthly dividend (currently a healthy 6.78%) into JNK and increase the number of shares I have. I am not going to worry about the share price - it will get dollar averaged every month anyways.

Renoir and Turner: 1 Unit each in DEO and VZ. Both doing fine. In addition, I am holding various amounts of DVY in different accounts to hold small sums accumulated through dividends.

Growth Since Last Taking Stock

The Dec 2012 Taking Stock had the total account value at 46.6 Units - so we are looking at a growth of 1.8 Units - 3.86% in a month. A part of the growth is because if new contributions of course. It is likely that we will reach 50 Units of total portfolio value next month - that will be something to celebrate.Artwork of the day - not really one artwork - but the place that holds Bernini's masterpiece - Santa Maria Della Vittoria Church in Rome. This is of special significance - since I will be visiting Rome soon and will be staying at a hotel right next to this magnificent building.

Tuesday, January 22, 2013

Taking Stock: Dec 2012

Closing the year with the last Taking Stock post of the year. It is coming a little late because of my year end vacation. Much of my investments were in auto-pilot past few weeks - so not much to report except year end larger contributions and usual market fluctuations. I also converted an non-deductible IRA into a ROTH IRA - actually combined with an existing ROTH IRA.

Total Investment Portfolio: 46.6 Units

VanGogh: 11 Units in an aggressive asset allocation model - 70% Stock (30% US, 20% Developed Non-US, 20% Emerging Markets), 30% Bonds. I am waiting for the next rebalancing opportunity to reduce my bond exposure - especially with long term treasuries.Bernini: 11 Units, in a conservative asset allocation model - 53% Stock (28% US, 25% International), 33% Bonds, 14% Real Estate and Others. It is on auto-pilot - it will go where it will go. I am assuming a nominal 3% growth rate for this account.

ElGreco: 10 Units in an aggressive asset allocation model - 70% Stock (40% US, 30% International), 30% Bonds. I will be moving these to a selection of actively managed mutual funds pretty soon.

Klimt: 2 Units in a fixed rate bond fund.Currently yielding 5.67%. Ahhh... the satisfaction of getting perfectly predictable yields. I will think about moving this when the yield goes below 5% - right now I am happy with flat 5.67% yield with no principal fluctuations.

Durer: 3 Units in a Target Retirement Fund with 2050 target. It is currently 90% Stock (67% US, 23% International) and 10% Bonds. I am looking to move these out to an IRA so that I can have more control over this account.

Bruegel: 3 Units, current holdings EPI, FXI and INTC. INTC is struggling to break free but has a decent dividend return. EPI and FXI are looking rather good recently.

Monet: 2 Units, I am holding EWP and F here - and they are both going gangbusters.

DaVinci: 2 Units in JNK for steady returns.Currently yielding 6.89%. There has been some principal appreciation there too - but I am sure that is not going to last for long.

Renoir and Turner: 1 Unit each in DEO, VZ.

Growth Since Last Taking Stock

Last Taking Stock had total portfolio value of 41.6 Units. End of Dec 2012, we stand at 46.6 Units. This shows a pretty solid 12.02% growth in a little more than a month. Of course, similar to last time, much of the growth is because of year end contributions to tax saving accounts.

Labels:

Bernini,

Bruegel,

DaVinci,

Durer,

ElGreco,

Klimt,

Monet,

Renoir,

Taking Stock,

Turner,

VanGogh

Subscribe to:

Comments (Atom)